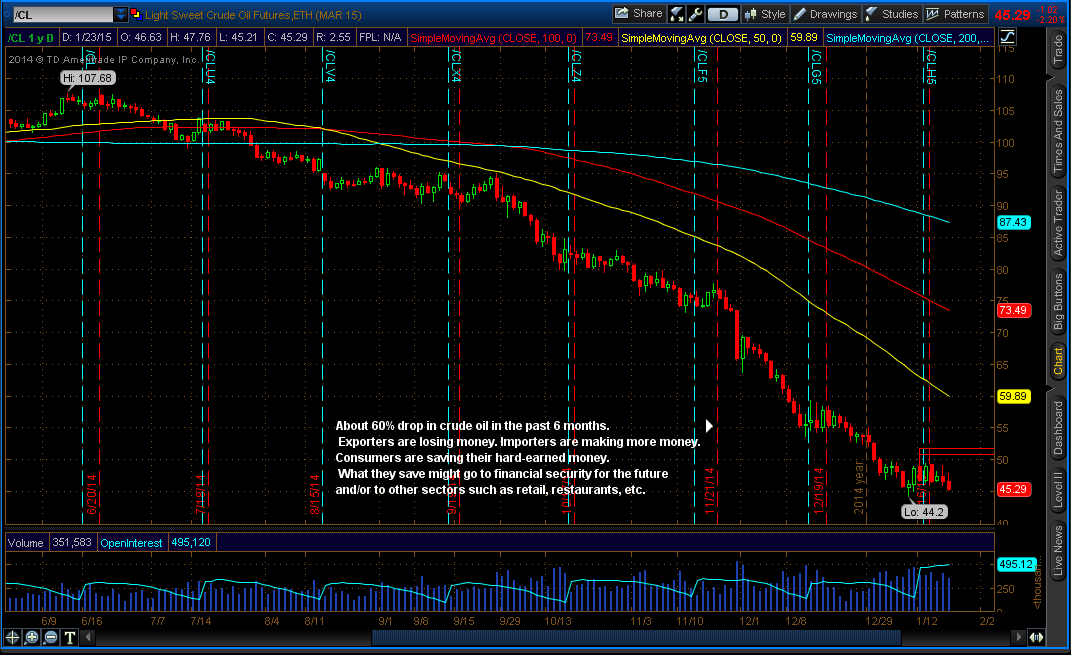

Last Wednesday (January 28, 2015), the Federal Reserve released its meeting statement for January 2015. They kept interest rates unchanged, for now. They maintained the key word “patient” on interest rate hike. “Patient” says that FOMC is not in a rush to raise the interest rates. Federal Open Market Committee (FOMC) in the statement said “…economic activity has been expanding at a solid pace. Labor market conditions have improved further, with strong job gains and a lower unemployment rate.” They viewed the economy in a good shape overall. Regarding inflation, they said ” Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices.” They are blaming declining oil prices for the decreasing inflation. They also said “Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate.” They expect inflation to decline as oil continues to decline in the near term. “Near term” can be about 6 months. They’re also saying that they expect oil prices to increase in “medium term”, which also can lift inflation. “Medium term” can be around 2 years.

In the statement, they are giving us some clues of future rate hike. “…readings on financial and international developments.” can account for rates. If the future financial reports are positive and international situations cools down, they might go for rate hike. Therefore, “…the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” What they said in 3rd paragraph of the last 2 sentences can be very helpful in predicting timing of rate hike, “Based on its current assessment, However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated. If the future financial reports come out very positive and way better than expectations, we can conclude that rate hike is nearing. If, it’s worse than expectations, then we can conclude that rate hike is too far, but reachable.

All 10 FOMC members agreed with the statement (unanimous) since June 2014. If a certain situation slightly changes. Some, but not all might change their views. If a certain situation changes dramatically, all of FOMC members might be unanimous in the future statements.

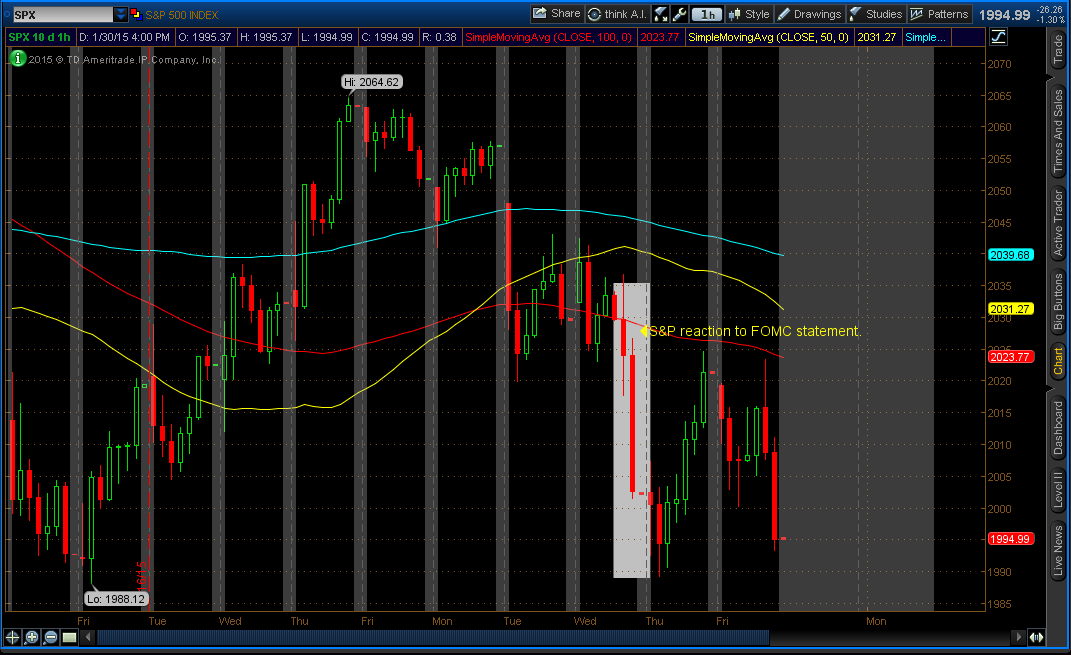

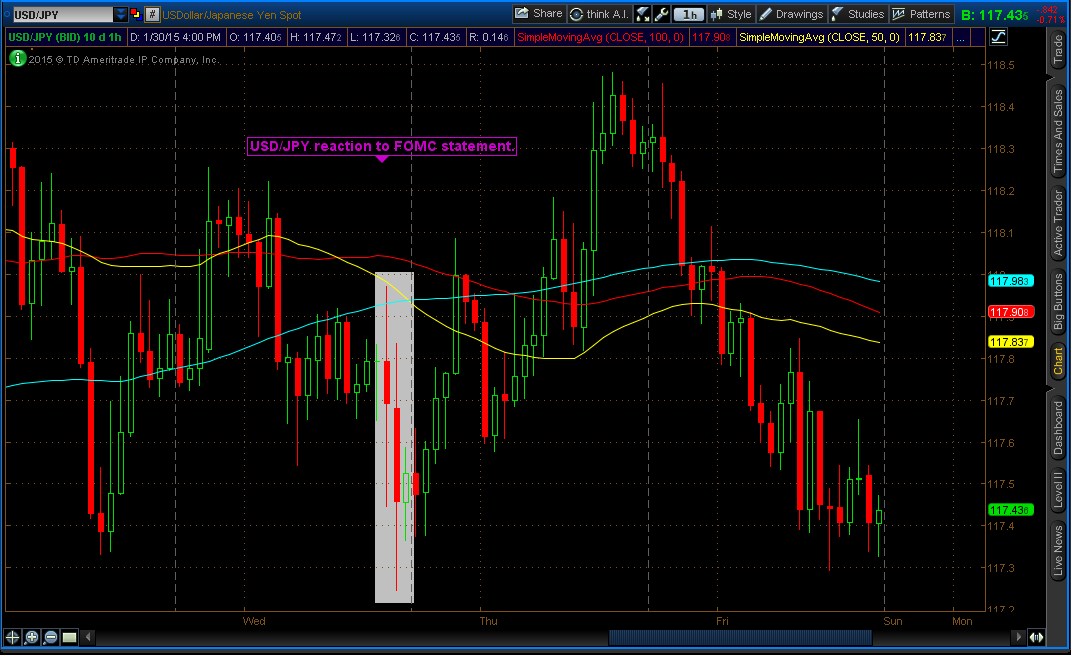

Financial markets’ reactions to FOMC statement.

I will be watching future financial reports such as ISM Manufacturing PMI and jobs reports, which are coming out next week. Using these types of reports and more, I will try to time the rate hike. As of right now, I believe it’s coming in the summer.