The Power of Time and Compounding

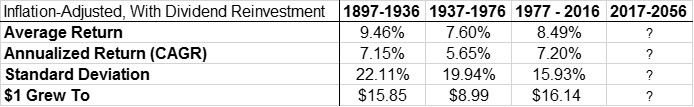

Over the past 40 years (1977 to 2016), S&P 500 has had inflation-adjusted annualized return rate of 7.20%, that’s having dividends reinvested. That means $1 grew to $16.14.

Without dividend reinvestment, S&P 500 has had annualized return of 4.12%, which means $1 grew to $5.02.

Can you see the power of time and compounding? I hope you see it.

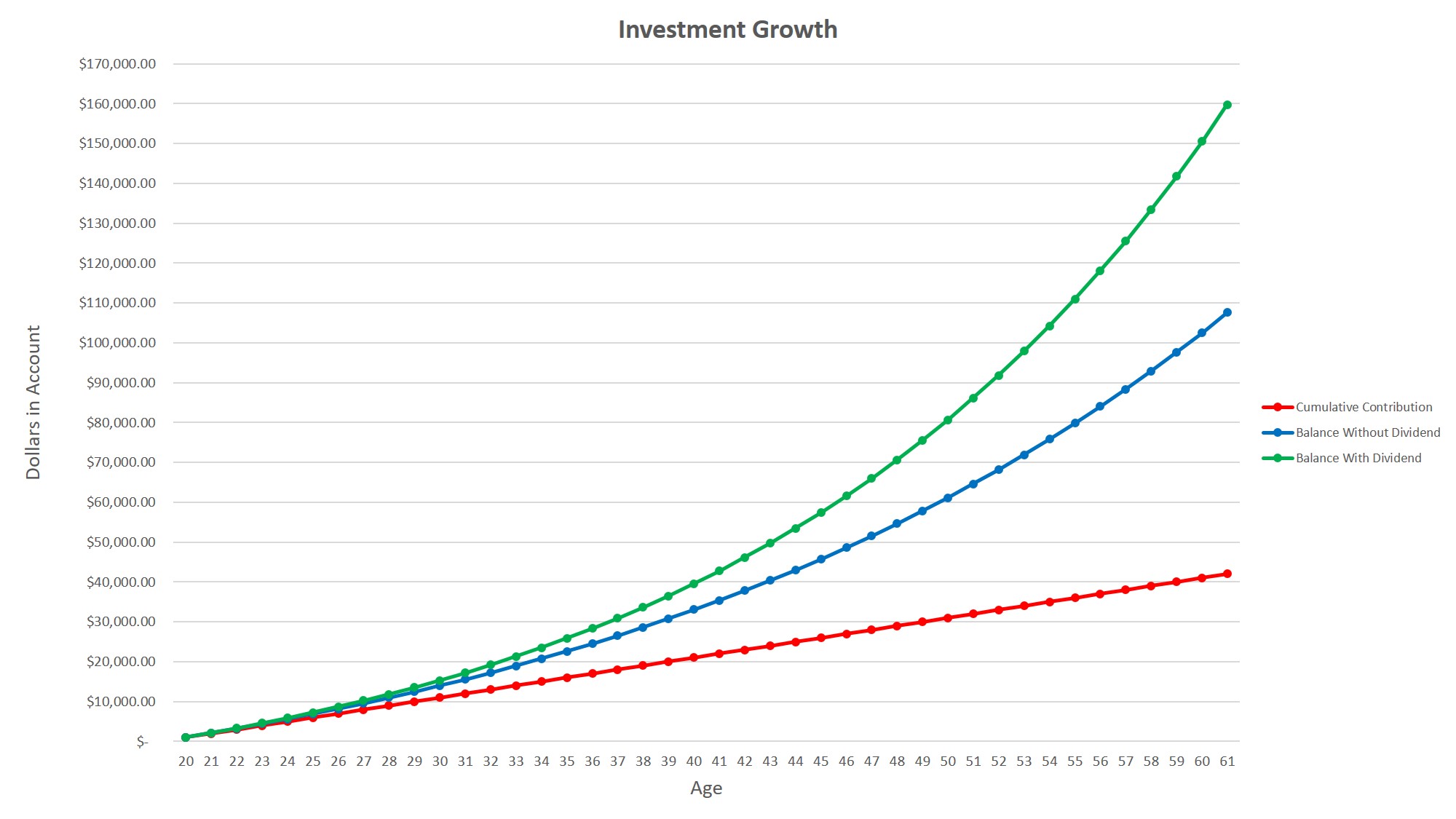

Let’s assume you’re 20-years-old, saving $1,000 each year for the next 40 years. When you’re 59, you will have $40,000 in cash. That is considering zero inflation.

Now, let’s assume you invest in the market that will give you inflation-adjusted annualized return of 5%, without dividends. When you’re 59, you will have $97,622.30.

Annual Contribution – $1,000

Dividend Yield – 1.5%

Expense Ratio – 1.0%

Lastly, let’s assume you invest in the market that will give you inflation-adjusted annualized return of 5%, with 1.5% annual dividend. When you’re 59, you will have $141,731.09.

Oh My God! The Power of Time and Compounding!

If you want to invest, invest now. Don’t let all-time highs scare you.

S&P 500 is currently yielding 1.93% dividend. Since the late 1800s, the lowest dividend yield was 1.11% in August 2000. The average dividend yield is 4.38%.

The returns you see above and below are before taxes. Tax laws might be different in 2056.

In this post, I will outline some of my plans to be a very long-term investor. I’m mostly trader and investor with less than the 5-year horizon.

Money Should Not Be Emotional

Over a year ago, I tried to open a ROTH IRA (retirement) account. After filling out the answers to countless questions, the application asked me to provide a proof of income. At the time, I did not have a job. So I just gave up on the application and did not think about it until last January.

I spent so much money in December and January alone, the expense amount freaked me out. I asked myself two key questions:

- What can I do to save more?

- What are the non-mandatory expenses?

One of the ways I can save more is, believe it or not, recycling bottles/cans (I don’t consider it income). In a family house of 6, we drink a lot, especially water. I drink about 12 bottles of water a day….using the same bottle. I fill the bottle with boiled water. Others just waste the bottles. I rather profit from people’s mistakes.

All those bottles collected in about two weeks made me $5.65, worth almost 6 pizzas, 2 each day. Or 6 yogurts, 3 each day.

If I make $10 every month for two hours of work, I can make $120 a year. That money can add up over the long term once invested in dividend-yielding ETFs.

I will not continue collecting bottles/cans (side hustle) once I get a full-time job/live on my own. I’m doing this now because I don’t even do my own laundry….yet.

I also figured out the non-mandatory expenses to cut back on, specifically on “ex”-food items I used to buy on a pulse. Small purchases (gum, candy, etc), for example, can add up over time. Those purchases are paid in cash. Well, I don’t carry a lot of cash. I carry reasonable amount. How you define ‘reasonable’ is up to you.

Why I don’t carry a lot of cash:

- No track of cash flow. Credit card allows that

- Risk of theft

- Worried about losing the wallet

- To avoid small purchases

Savings and Investing on Auto-Pilot

In January and February, I decided to open multiple accounts to keep my cash, rainy day savings, investments and deposited more money into my Robinhood brokage account.

Why multiple accounts? Because I don’t trust FDIC, which “protects” or “insurances” depositors to at least $250,000 per bank. I’m paranoid someday FDIC won’t be able to protect every depositor, after a major hack or something. Who knows, it might even take a long time to get depositors’ money back.

What if I lose my debit card? I wouldn’t want all/most of my cash in that account. At most, I keep 30% of my cash in the checking account. Now, my cash and short-term securities (stocks, etc) are diversified among multiple accounts.

Besides the savings account (almost 1% interest), I opened two more investments accounts. These accounts are different than Ameritrade/Robinhood.

Financial Literacy Is Very Important

The first account is Acorns, an investment app that rounds up user purchases and invests the change in a robo-advisor managed portfolio. For me, there’s no fee since I’m a student and under 24. I don’t trust robo-advisers, but this case is different. There are only 6 ETFs which I have looked into and decided they were good for the long-term in a diversified portfolio. 75% of its users are millennials.

79% of millennials are not invested in the stock market. I find that as a real concern.

The second account is Stash, an investment app that allows users to pick stocks in themed based investments around wants (Clean & Green, Defending America, Uncle Sam, etc). This app is also targeted toward millennials. Unlike Acorns, Stash charges you even if you are a student. But, the first three months are free. Like Acorns, Stash has a subscription fee of $1 per month for accounts under $5,000 and 0.25% a year for balances over $5,000.

Studies show 48% of Americans cite a lack of sufficient funds as their main barrier to investing. Luckily, technology is transforming the way people invest. Start small. Before you know it, it is big.

Both of the micro-investing apps are like savings/IRA accounts for me since I can grow my portfolio through dividends. I have checked out the ETFs Acorns invests in, they are good. I have checked out the ETFs Stash offers. Most of them are good. I have invested in the stable ones with low expense ratio relatively to its dividends.

Unlike ROTH IRA, I will need to pay taxes on realized capital gains, dividends and income interest.

Whopping 69% of Americans have less than $1,000 in a savings account and 50% of them have $0 in that account. All these people playing Candy Crush should be thinking about their future. Be a Robo-Saver and Be a Robo-Investor.

Note: All of my $$$ comes from off-book jobs, scholarships, prizes, and living under mommy and daddy’s roof (Can’t wait to move out). This post doesn’t mean I will stop trading. I will continue to trade forex, stocks, and commodities.