European Central Bank:

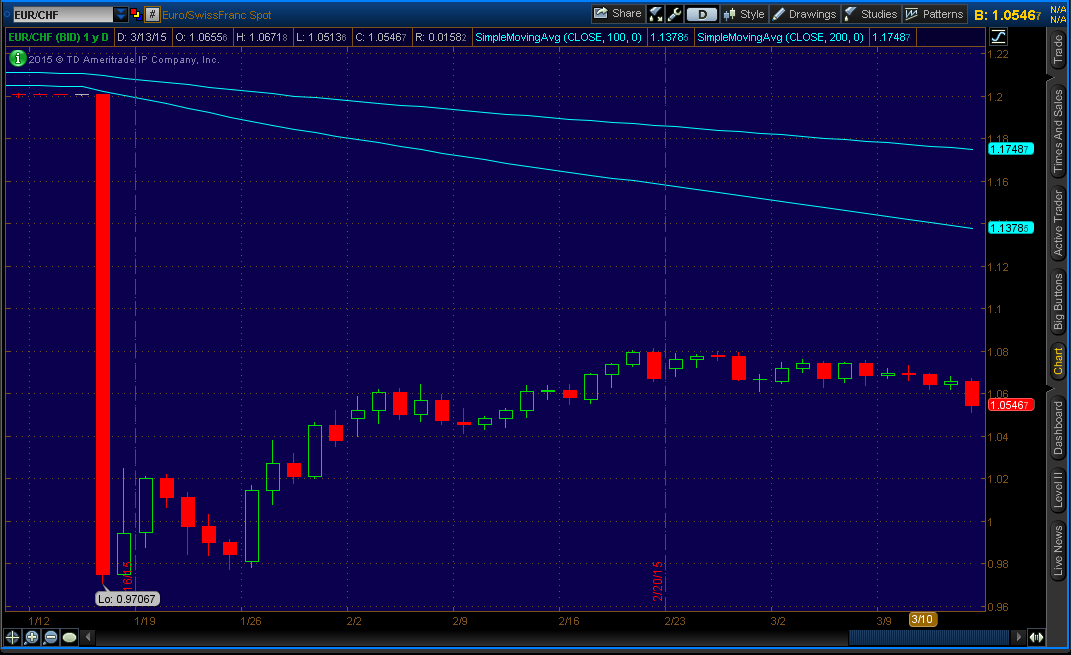

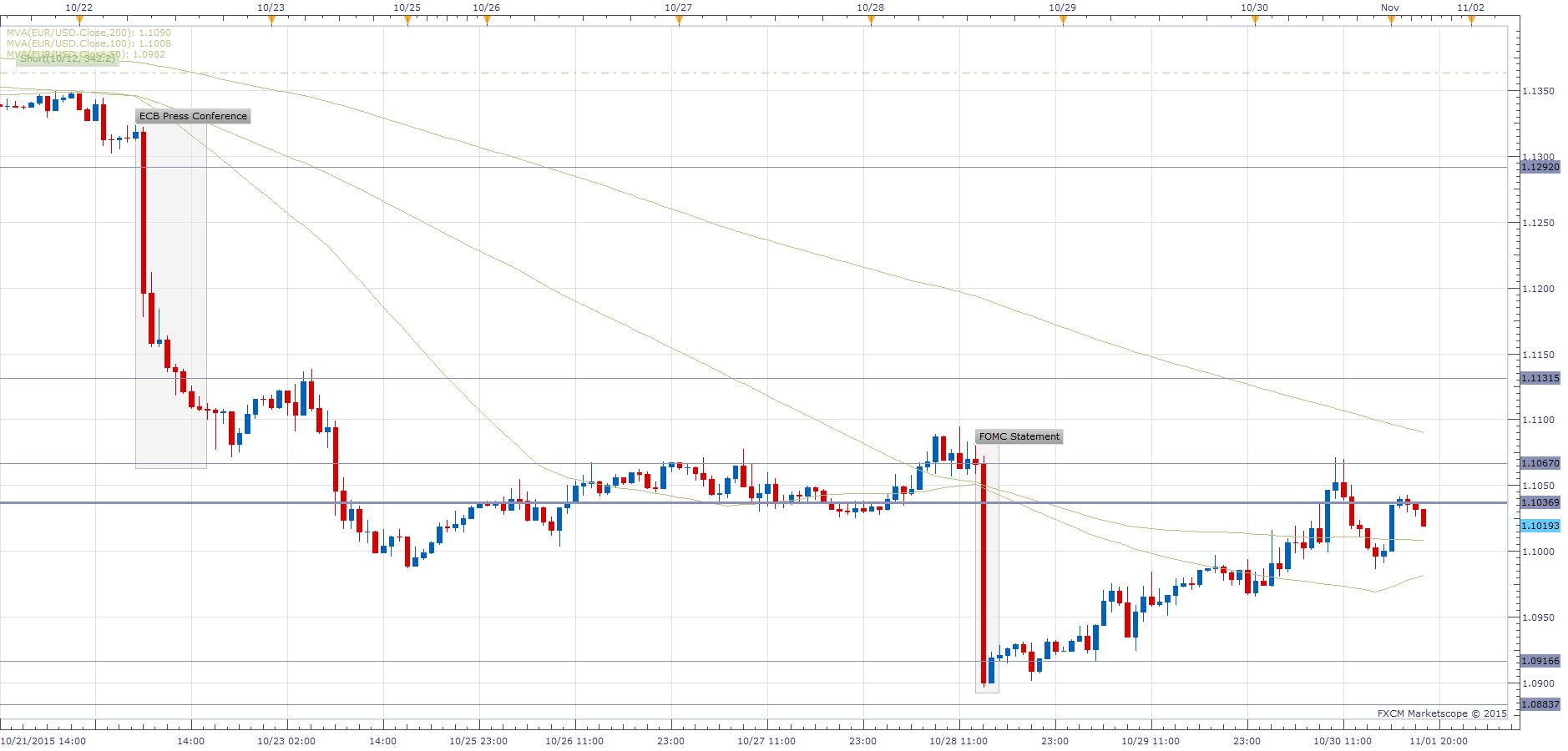

On October 22 (Thursday), European Central Bank (ECB) left rates unchanged, with interests on the main refinancing operations, marginal lending, and deposit rate at 0.05%, 0.30% and -0.20, respectively. But the press conference gave an interesting hint. Mario Draghi, the President of ECB, was most dovish as he could be, “work and assess” (unlike “wait and see” before).

The central bank is preparing to adjust “size, composition and duration” of its Quantitative Easing (QE) program at its December meeting, “the degree of monetary policy accommodation will need to be re-examined at our December monetary policy meeting”, Draghi said during the press conference. They are already delivering a massive stimulus to the euro area, following decisions taken between June 2014 and March 2015, to cut rates and introduce QE program. In September 2014, ECB cut its interest rate, or deposit rate to -0.20%, a record low. Its 1.1 trillion euros QE program got under way in March with purchases of 60 billion euros a month until at least September 2016.

When ECB cut deposit rate to record low in September 2014, Mr. Draghi blocked the entry to additional cuts, “we are at the lower bound, where technical adjustment are not going to be possible any longer.” (September 2014 press conference). Since then, growth hasn’t improved much and other central banks, such as Sweden and Switzerland, cut their interest rates into much lower territory. Now, another deposit rate-cut is back, “Further lowering of the deposit facility rate was indeed discussed.” Mr. Draghi said during the press conference.

The outlook for growth and inflation remains weak. Mr. Draghi – famous for his “whatever it takes” line – expressed “downside risks” to both economic growth and inflation, mainly from China and emerging markets.

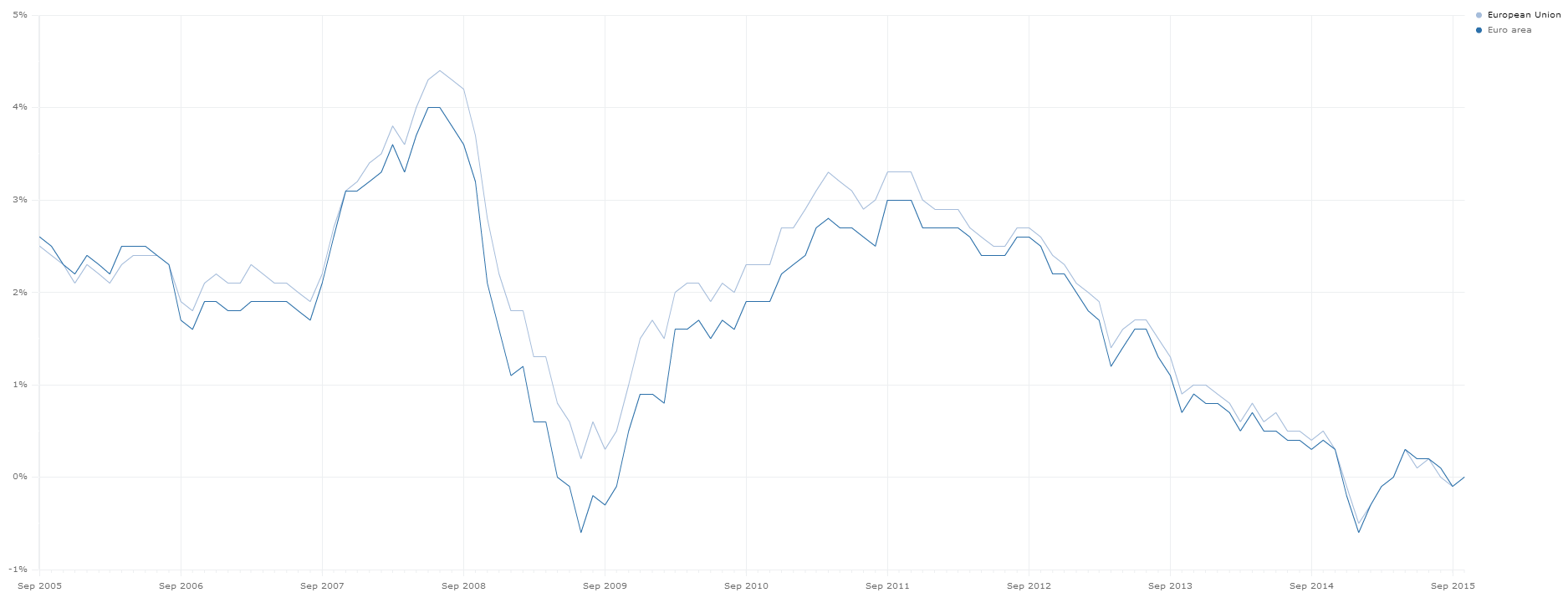

Given the extent to which the central bank provided substantial amount of stimulus, the growth in the euro area has been disappointing. The euro area fell into deflation territory in September after a few months of low inflation. In September, annual inflation fell to 0.1% from 0.1% and 0.2% in August and July, respectively. Its biggest threat to the inflation is energy, which fell 8.9% in September, down from 7.2% and 5.6% in August and July, respectively.

Source: Eurostat

Europe’s economy will slow down due to export demand decreasing from China and emerging countries, where a quarter of all euro-zone exports gets shipped to.

As the ECB left the door open for more QE, Euro took a dive. Euro took a deeper dive when Mr. Draghi mentioned that deposit rate-cut was discussed. Deposit rate cut will also weaken the euro if implemented. After the press conference, the exchange rate is already pricing in a rate-cut. Mentions of deposit rate-cut and extra QE sent European markets higher and government bond yields fell across the board. The Euro Stoxx 50 index climbed 2.6%, as probability of more easy money increased. Swiss 10-year yield fell to fresh record low of -0.3% after the ECB press conference. 2-year Italian and Spanish yields went negative for the first time. 2-year German yield hit a record low of -0.32.

Regarding the exchange rate (EUR/USD), I expect it to hit a parity level by mid-February 2016.

As I stated in the previous posts, I expect more quantitative easing by ECB (and Bank of Japan also). I’m expecting ECB to increase its QE program to 85 billion euros a month and extend it until March 2017. When ECB decides to increase and extend the scope of its QE, I also expect deposit rate-cut of 10 basis points.

ECB will be meeting on December 3 when its quarterly forecasts for inflation and economic growth will be released. The only conflict with this meeting is that U.S. Federal Reserve policy makers meets two weeks later. ECB might hold off until the decision of the Fed, but the possibility of that is low.

EUR/USD Reaction:

U.S. Federal Reserve:

On October 28 (Wednesday), the Federal Reserve left rates unchanged. The bank was hawkish overall. It signaled that rate-hike is still on the table at its December meeting and dropped previous warnings about the events abroad that poses risks to the U.S. economy.

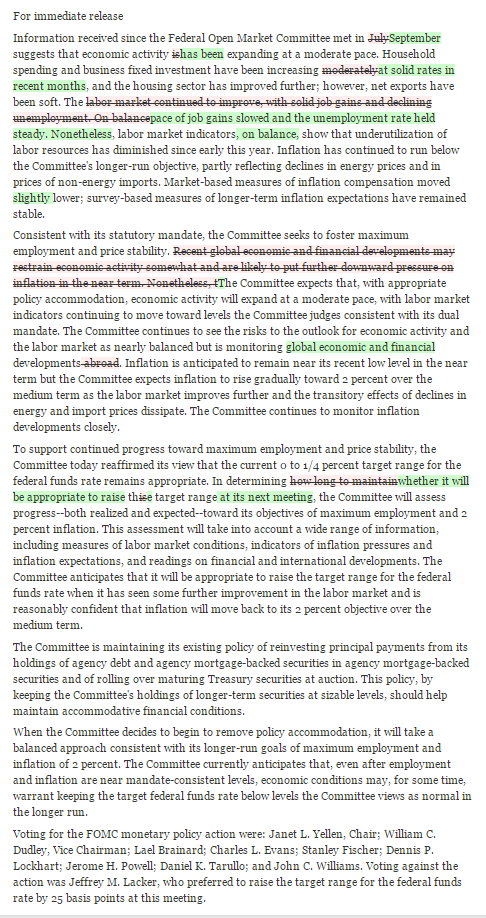

It does not make sense to drop “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.” (September statement) I’m sure the events abroad has its risks (spillover effect) to the U.S. economy and the Fed will keep an eye on them.

In its statement, it said the U.S. economy was expanding at a “moderate pace” as business capital investments and consumer spending rose at “solid rates”, but removed the following “…labor market continued to improve…” (September statement). The pace of job growth slowed, following weak jobs report in the past several months.

Let’s take a look at the comparison of the Fed statement from September to October, shall we?

Source: http://projects.wsj.com/fed-statement-tracker/

The Fed badly wants to raise rates this year, but conditions here and abroad does not support its mission. Next Federal Open Market Committee (FOMC) meeting takes place on December 15-16. By then, we will get important economic indicators including jobs report, Gross Domestic Product (GDP), retail spending and Consumer Price Index (CPI). If we don’t see any strong rebound, rate-hike is definitely off the table, including my prediction of 0.10% rate-hike for next month.

The report caused investors to increase the possibility of a rate increase in December. December rate-hike odds rose to almost 50% after the FOMC statement.

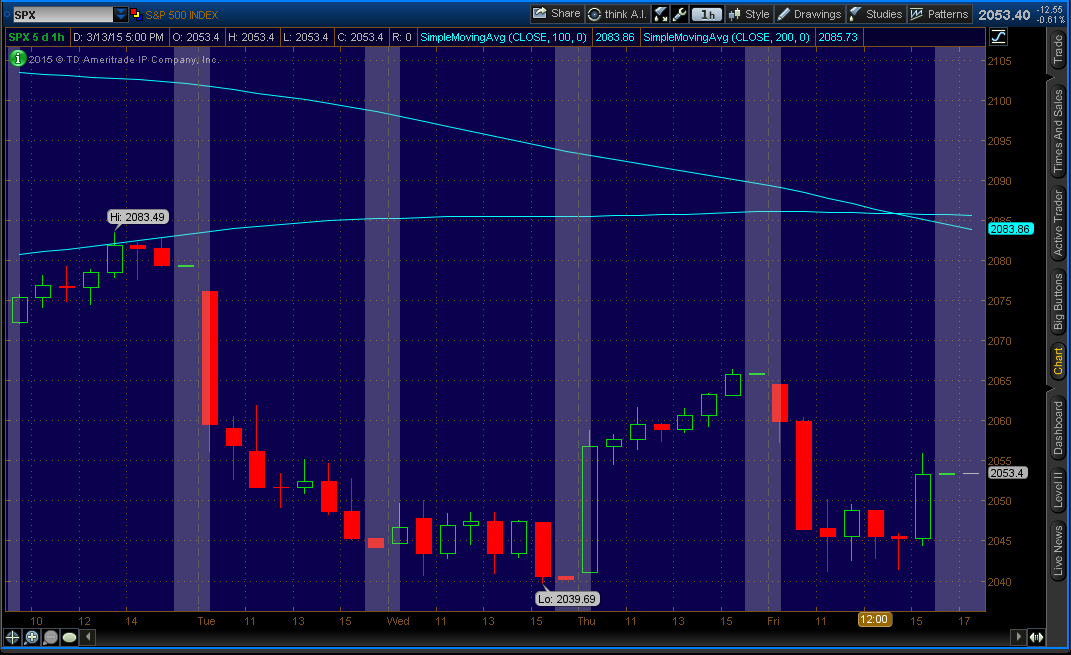

Greenback (US Dollar) Reaction:

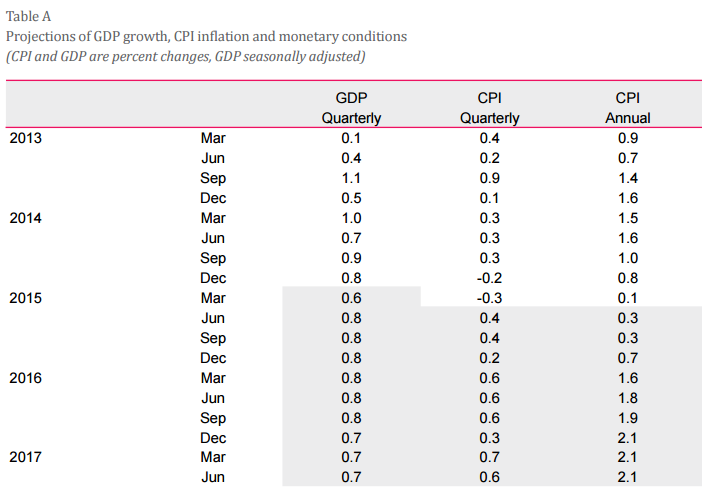

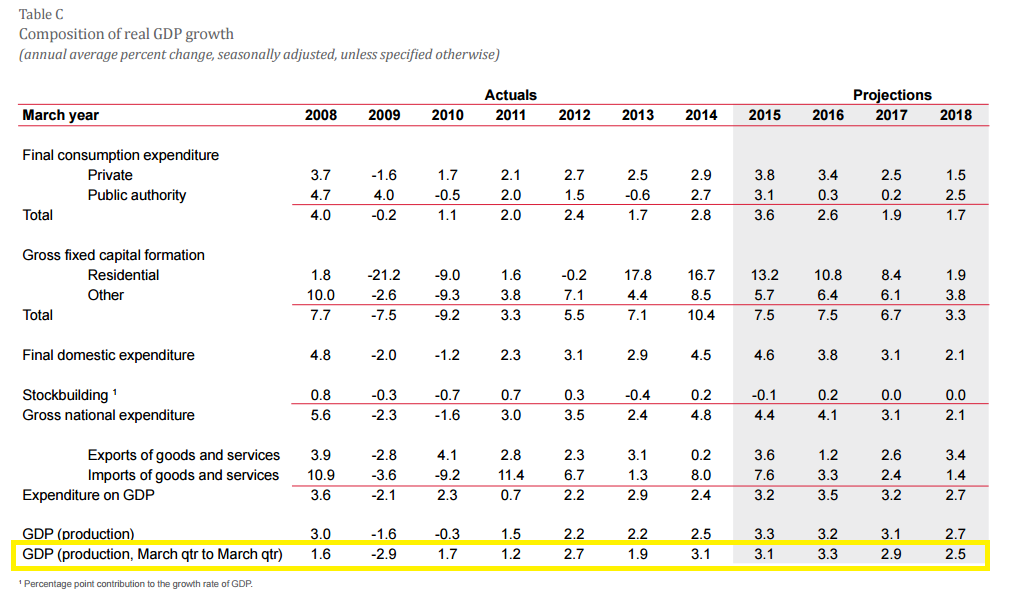

Reserve Bank of New Zealand:

On October 28 (Wednesday), Reserve Bank of New Zealand (RBNZ) left rates unchanged at 2.75% after three consecutive rate-cuts since June. The central bank’s Governor Graeme Wheeler said that at present “it is appropriate to watch and wait.” “The prospects for slower growth in China and East Asia” remains a concern.

Housing market continues to pose financial stability risk. House price inflation is way higher. Median house prices are about nine times the average income. Short supply caused the house prices to increase significantly. “While residential building is accelerating, it will take some time to correct the supply shortfall.” RBNZ said in a statement. Auckland median home prices rose about 25.4% from September 2014 to September 2015, “House price inflation in Auckland remains strong, posing a financial stability risk.”

Further reduction in the Official Cash Rate (OCR) “seems likely” to ensure future CPI inflation settles near the middle of the target range (1 to 3%).

Although RBNZ left rates unchanged, Kiwi (NZD) fell because the central bank sent a dovish tone, “However, the exchange rate has been moving higher since September, which could, if sustained, dampen tradables sector activity and medium-term inflation. This would require a lower interest rate path than would otherwise be the case.” It’s a strong signal that RBNZ will cut rates to 2.5% if Kiwi continues to strengthening. I will be shorting Kiwi every time it strengthens.

“The sharp fall in dairy prices since early 2014 continues to weigh on domestic farm incomes…However, it is too early to say whether these recent improvements will be sustained.” RBNZ said in the statement. Low dairy prices caused RBNZ to cut rates. New Zealand exports of whole milk powder fell 58% in the first nine months of this year, compared with the same period in 2014. But, there’s a good news.

Recent Chinese announcement that it would abolish its one-child policy might just help increase dairy prices, as demand will increase. How? New Zealand is a major dairy exporter to China. Its milk powder and formula industry is likely to benefit from a baby boomlet in China.

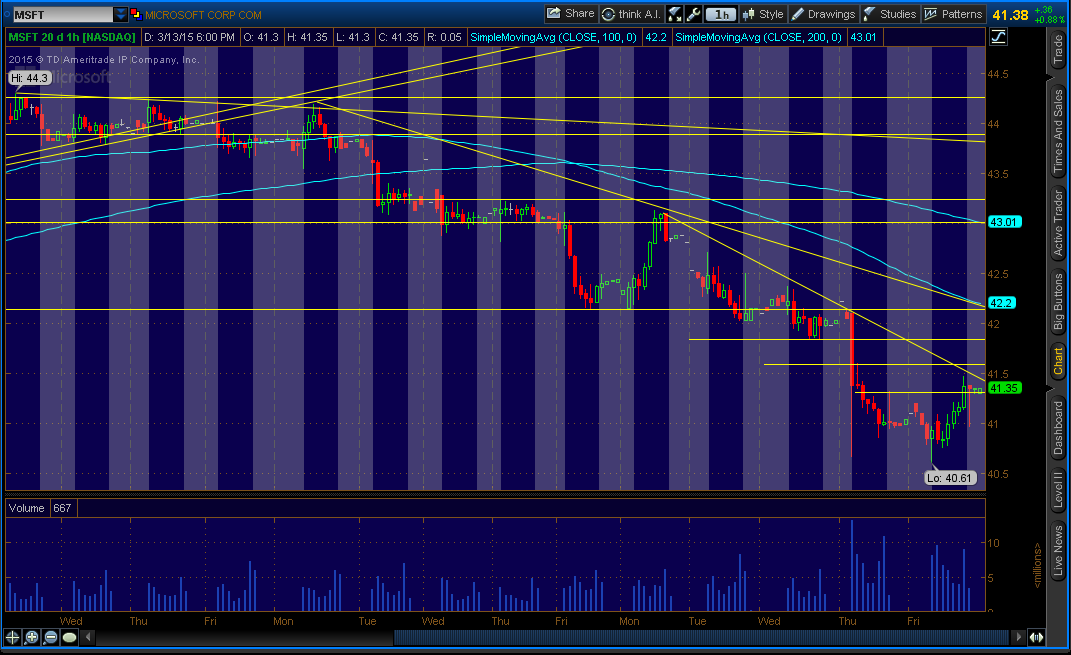

NZD/USD Reactions:

Bank of Japan:

On October 30 (Friday), Bank of Japan (BoJ) maintained its monetary policy unchanged and downgraded its growth and inflation projections. BoJ left – by 8-1 majority vote – its QE program at current level of 80 trillion yen (about $660 billion) a year.

BoJ expects to hit its 2% inflation target in late 2016 or early 2017 vs. previous projection of mid-2016. Again and Again. This is the second time BoJ changed its target data. The last revision before this week was in April. It also lowered its growth projections for the current year by 0.5% to 1.2%.

They also lowered projections for Core-CPI, which excludes fresh food but includes energy. They lowered their forecasts for this fiscal year to 0.1%, down from a previous estimate of 0.7%. For the next fiscal year, they expect 1.4%, down from a previous estimate of 1.9%. Just like other central banks, BoJ acknowledged that falling energy prices were hitting them hard.

Low inflation, no economic growth, revisions, revisions, and revisions. Nothing is recovering in Japan.

Haruhiko Kuroda, the governor of BoJ, embarked on aggressive monetary easing in early 2013. So far he hasn’t had much success.

In the second quarter (April-June), Japan’s economy shrank at an annualized 1.2%. Housing spending declined 0.4% in September from 2.8% in August. Core-CPI declined for two straight months, falling 0.1% year-over-year both in September and August. Annual exports only rose 0.6% in September, slowest growth since August 2014, following 3.1% gain in August.

Exports are part of the calculation for Gross Domestic Product (GDP). Another decline in GDP would put Japan into recession, which could force BoJ to ease its monetary policy again. Another recession would be its fourth since the 2008 financial crisis and the second since Shinzo Abe (Abenomics), the Prime Minister of Japan, came to power in December 2012.

Its exports to China, Japan’s second-biggest market after the U.S., fell 3.5% in September. The third-quarter (July-September) GDP report will be released on November 16.

April 2014 sales tax (sales tax increased from 5% to 8%) increase only made things worse in Japan. It failed to boost inflation and weakened consumer sentiment.

In April 2013, BoJ expanded its QQE (or QE), buying financial assets worth 60-70 trillion yen a year, including Exchange Traded Funds (ETF).

QQE stands for Quantitative and Qualitative Easing. Qualitative easing targets certain assets to drive up their prices and drive down their yield, such as ETF. Quantitative Easing targets to drive down interest rates. Possibility of negative interest rates has been shot down by BoJ. But, why trust BoJ for their word? Actions speak louder than words.

In October 2014, BoJ increased the QQE to an annual purchases of 80 trillion yen. When is the next expansion? December?

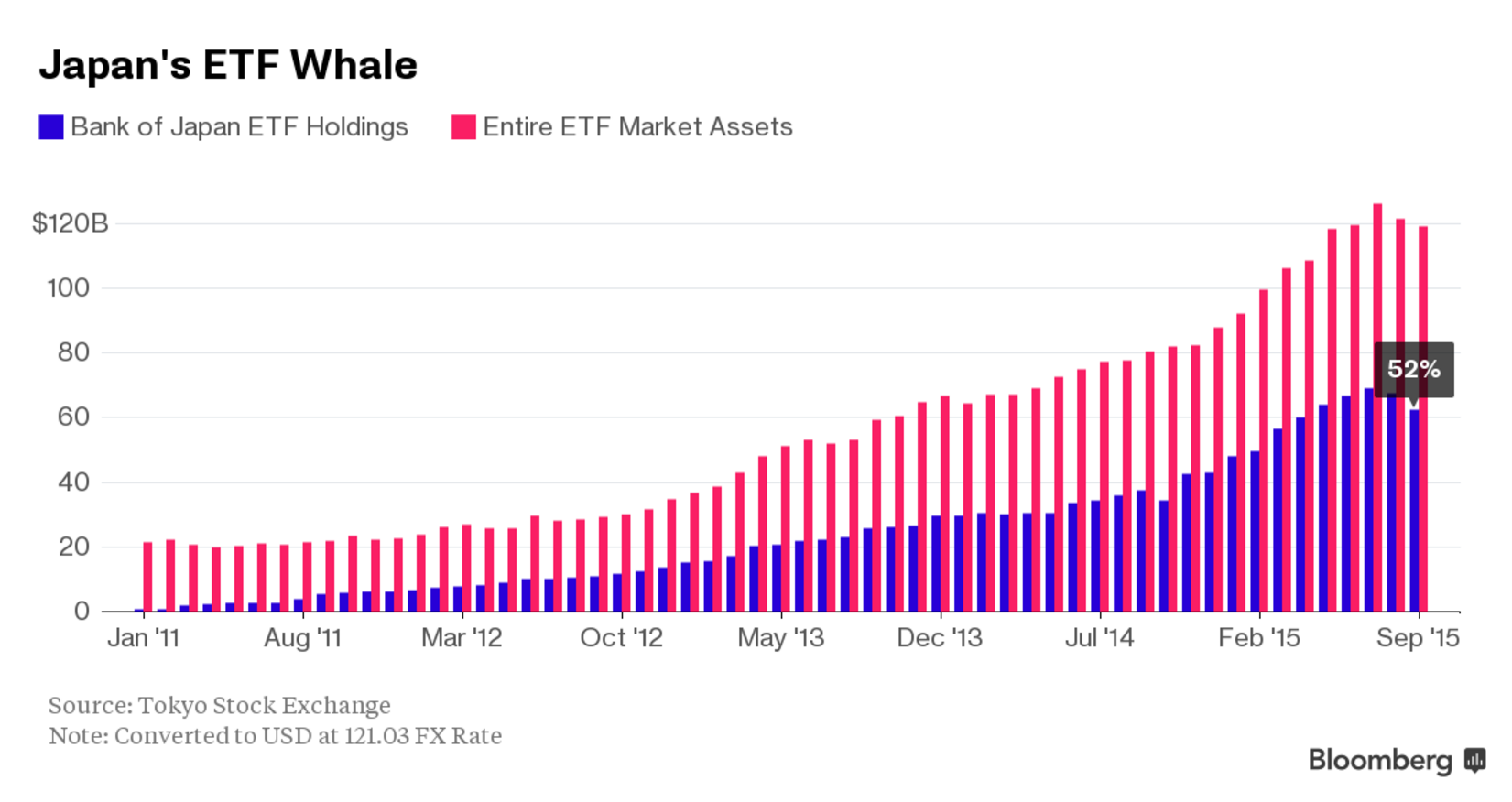

Did you know that the BoJ owns 52% of Japan’s ETF market?

Source: Bloomberg

For over a decade, BoJ’s aggressive monetary easing through asset purchases did not help Japan’s economy. Since 2001, the central bank operated 9 QEs and is currently operating its current 10th QE (or QQE). The extensions of its QE are beginning to become routine or the “new normal.”

Growth and prices are slowing in China, with no inflation in United Kingdom, Euro-zone, and the U.S. The chances that Japan will crawl out of deflation are very slim.

USD/JPY Reaction:

Next week, both Reserve Bank of Australia (RBA) and Bank of England (BoE) will meet. Will be very interesting to watch.